The Home Loan Process

Demystifying Home Loans

If you haven’t experienced it before, the home loan process can feel overwhelming but the agents at Forty One Eleven Real Estate will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, we partner with some of the best lenders in the industry. We would be happy, to introduce you, so you’ll be taken care of.

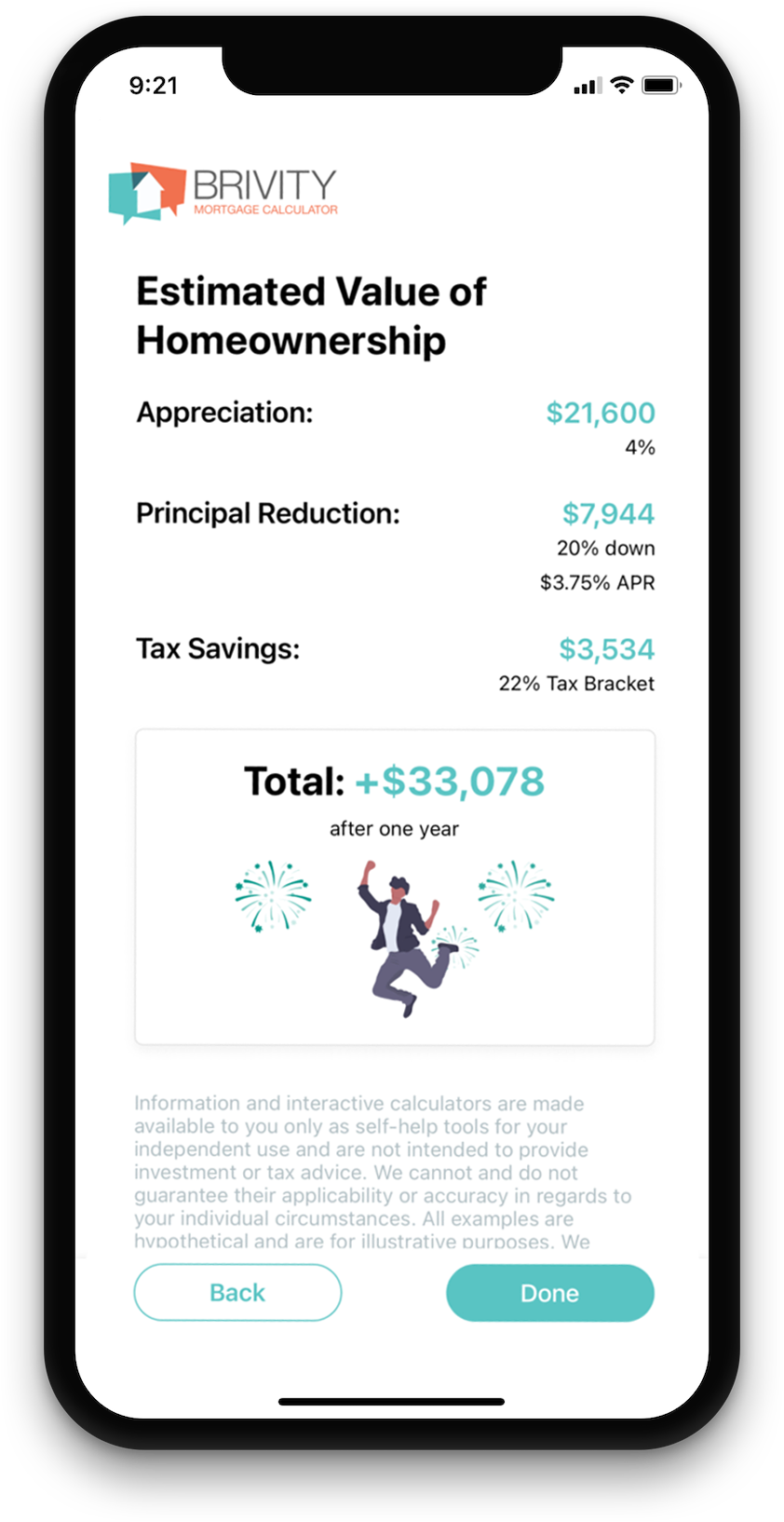

Get Pre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs. Your agents at Forty One Eleven Real Estate can introduce you to several lenders to help you find the best fit. We will then work with the lender to ensure the homes we view match your budget so you'll have a smooth home purchase experience. We work with commercial lenders, private lenders, and traditional mortgage companies.

We Help You Get The Best Loan

Start The Process

Let us assist you in locating the most suitable local loan officer who can offer you competitive rates and tailor-made programs to suit your specific requirements. Complete this form, and we'll promptly connect you with a lender today!

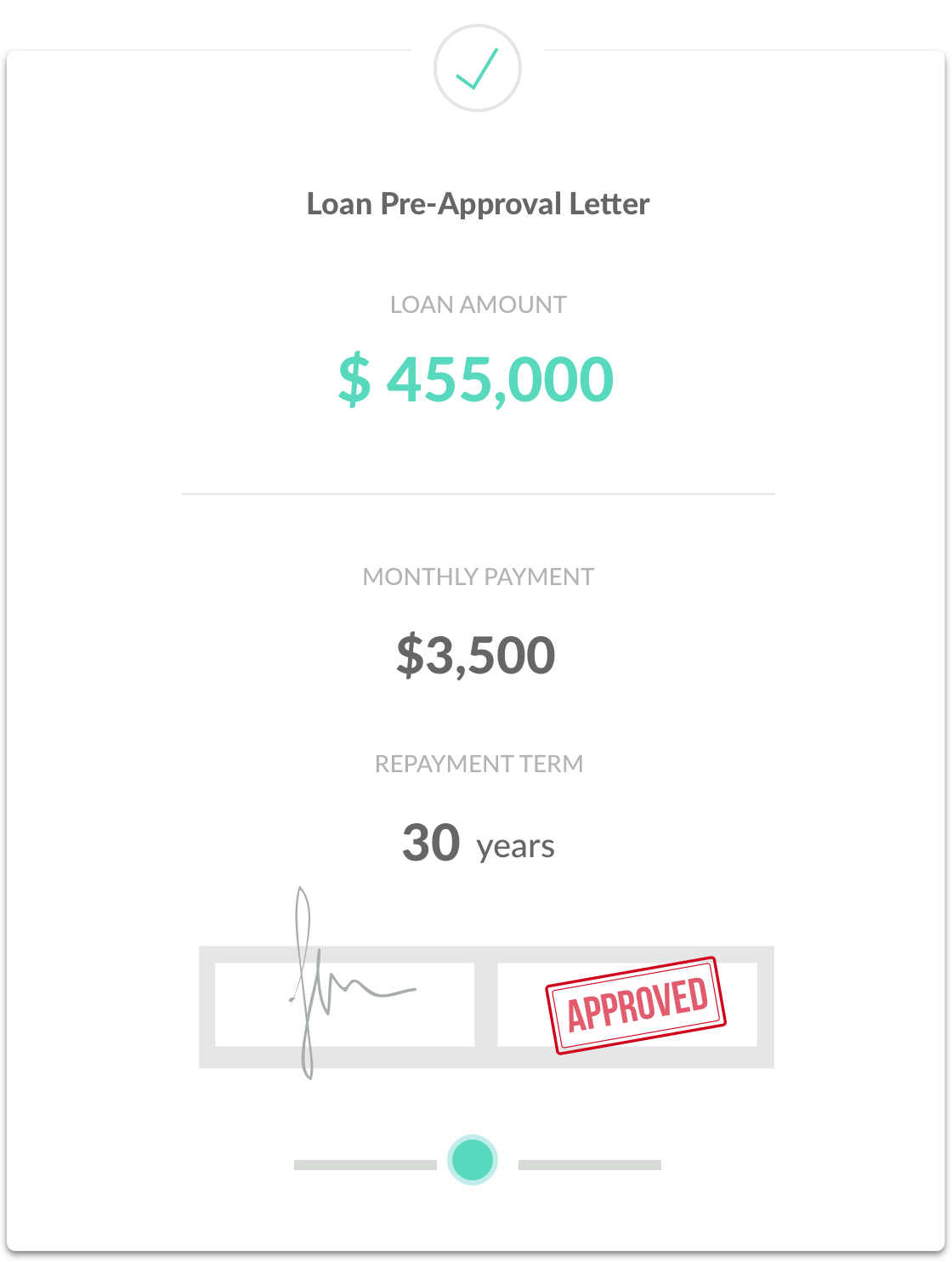

Application & Processing

What happens when a loan goes "live"

When Forty One Eleven Real Estate helps you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is then submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Closing

Signing and Finalizing the deal

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Don't worry, your agents at Forty One Eleven Real Estate will walk you through every step in this process. Congratulations, happy homeowner!